Buy now, Pay later.

Anywhere.

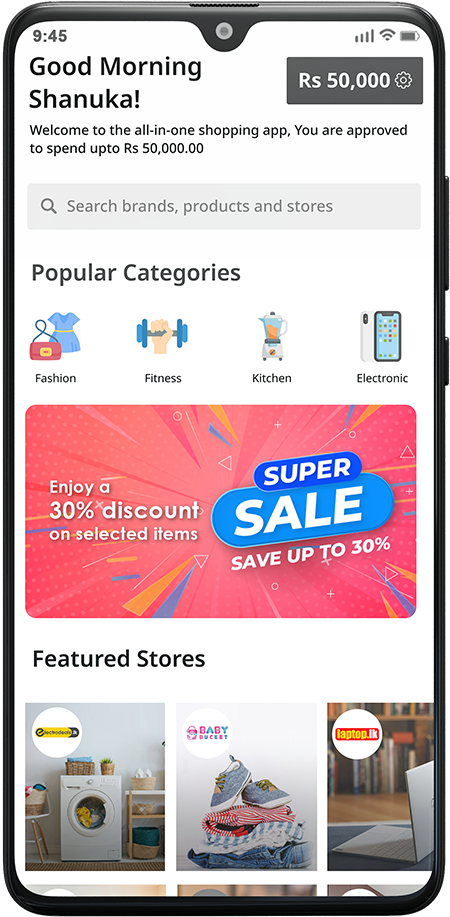

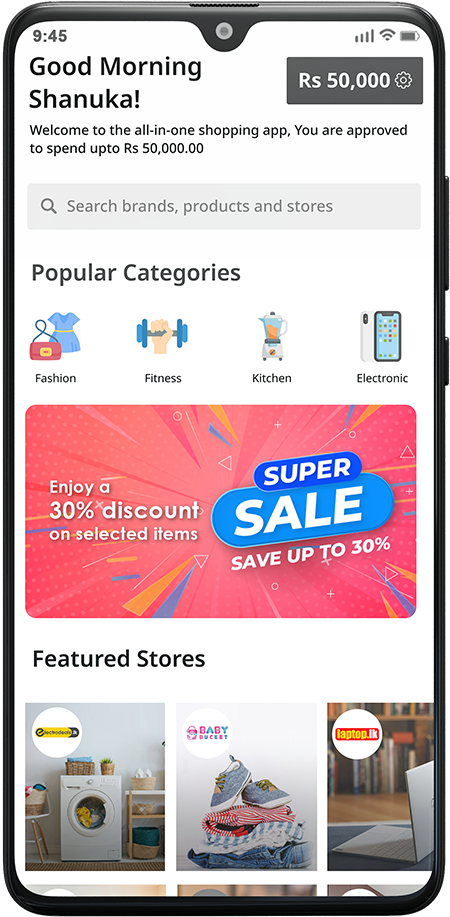

From Biryani to Smart Phone, get the stuff you need now and Pay in 4, interest-free instalments over nine weeks. Do it all in the app, easily and securely!

From Biryani to Smart Phone, get the stuff you need now and Pay in 4, interest-free instalments over nine weeks. Do it all in the app, easily and securely!

No long applications or complicated terms & conditions. Have your NIC, address, and employment proof handy.

Shop anywhere online and split your purchase into 4 interest-free installments. We remind you so you never miss a payment.

Save items in the app. Get push notifications when the price drops. Browse exclusive deals added daily.

We'll send reminders, so you never miss a payment. And if you do, we pause your account until you're back on track.

It's simple and easy to get started.

Download Moneta from the Google Play store. Have your phone number, address, and debit/credit card handy.

Choose Moneta at checkout and Pay in 4 interest-free instalments - make your first payment today and the rest over 9 weeks.

We'll send you reminders to help you get back on track.

We are committed to protecting the data and information of our customers. Our technologies are built around world-class data security tools and technologies. Our rock-solid secure processes and technology implementations combined with regulatory compliance make your data safe and secure, these strict protocols govern how we access, store and use member data.